So far we have chanted the virtues of free financial markets. Is there a no downside to the development of financial markets? What about scandals , scams and financial contracts which collapse in a worthless virtual heap?.

Let us first discuss the issues pertaining to the financial distress. Ever so often, a financial institution collapses with a rapidity that leads the astonished public to ask.” are the magnificent downtown headquarters of financial institutions simply fronts for houses of cards built by cardsharps?”. Even though the business of managing and dealing with money is likely to attract more than it’s fair share of rouges. Financial markets know this and protect themselves by placing a better emphasis on reputations and risk controls. The proportion of amoral activities in the financial business is not very different from the norm.

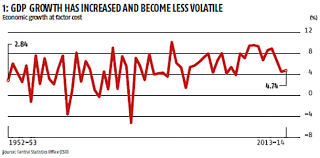

Nevertheless, when in trouble, financial firms tend to collapse much more quickly than industrial firms. There is a reason for this. The modern financial firm can create or destroy value much more rapidly than industrial firms. Take for example derivatives , they are much like dynamite when used properly they can be very beneficial as we have or the organisations have seen so far but when its in the hands of incompetent or unscrupulous hands, they can in few moments can create a catastrophe in the balance sheets of sizes which cannot be matched by even years of incompetent management at an industrial firm. Further, compounding the problem is that the financial markets are aware of the possibilities of misconduct and take action to protect themselves. Debt markets are loath to lend very long term to financial firms because they know that a financial firm’s creditworthiness can change overnight. They would prefer to lend very short term so that they can reassess the financial firm’s risks periodically. Let me offer a quick recap of the macroeconomic situation. Growth is stabilizing on the back of good harvest, strengthening exports and some early signs of resumptions of large organised projects. However, growth is still very weak. We have to work to ensure macroeconomic stability which means empowering growth, especially through investments, maintaining a moderate current account deficit for 2019-2020 will be close to , or below, the finance minister’s red line. Going forward, however, we need to continue on the path of fiscal consolidation constantly improving the sustainability and quality of fiscal adjustments. It is very important that we spend money on needed public investments.

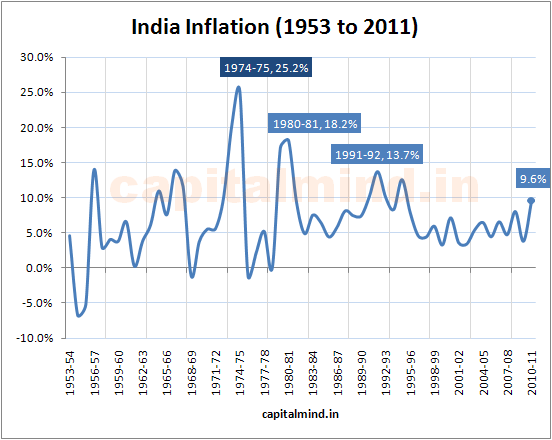

Good fiscal control will help us in our fight against inflation. So, will moderation in agricultural support price inflation, which will ensure that these prices only provide a baseline level of support when the farmer is in difficulty without displacing market prices. Prominent market prices, together with good dissemination of data on sowing patterns, can do a far better job than support prices in directing agricultural production to where it is most valuable and needed. Somewhat paradoxically, raising energy prices to market levels will also lead to a lower inflation over the medium term, the horizon over which the horizon is trying to contain inflation. The reason is that higher prices will reduce excessive consumption reduce subsidies and fiscal deficits and incentivize investment and consumption, even while determining prices by an increasingly stable and plentifully supplied global market for energy. The consequences for inappropriate or inadequate price adjustments will be that the Reserve Bank will have to bear more of the burden in combating inflation.